- January 22, 2014

- Posted by: John Fischer

- Category: Accredited Investors

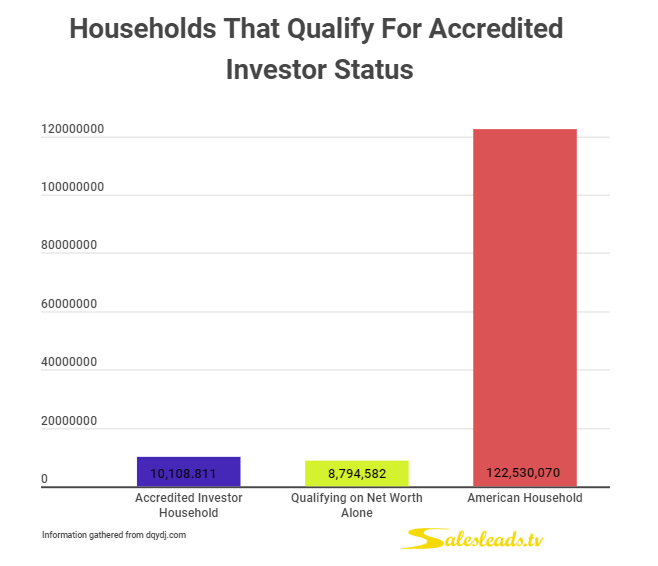

The SEC has strict rules for who can be considered an Accredited Investor. Issuers of private offerings are typically required to only accept investment dollars from an accredited investor which makes understanding the rules extremely important. The SEC recently lifted the ban on general solicitation, allowing companies to advertise but only if the company does not accept any capital from a non accredited investor.

Accredited Investor Definition

On the SEC website they detail who is an Accredited Investor, stating the following:

- “a bank, insurance company, registered investment company, business development company, or small business investment company;

- an employee benefit plan, within the meaning of the Employee Retirement Income Security Act, if a bank, insurance company, or registered investment adviser makes the investment decisions, or if the plan has total assets in excess of $5 millionn

- a charitable organization, corporation, or partnership with assets exceeding $5 million;

- a director, executive officer, or general partner of the company selling the securities;

- a business in which all the equity owners are accredited investors;

- a natural person who has individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person;

- a natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year; or

- a trust with assets in excess of $5 million, not formed to acquire the securities offered, whose purchases a sophisticated person makes.”

Calculating Net Worth

Issuers need to understand how the SEC calculates the net worth portion of the requirements. There are some lesser known rules that make the process more complicated than it initially appears to be.

For example, their primary residence cannot be included in the net worth calculation. The liability (mortgage) associated with the property is also not included. There is, however, a rule that if the debt on that property increased within the past sixty days the additional debt must be deducted from their net worth. Also if the debt on the property is greater than its value, that amount must also be deducted from their net worth.

To calculate their net worth have an investor list out all of their assets (bank balances, portfolio, other property etc) in one column and list out their debts in another column. Ask them to include their primary residence and mortgage so you can determine if the home is underwater. Ask the investor if they have increased their mortgage debt in the past sixty days.

If the investor’s home has positive equity, and they have not recently increased their mortgage debt, the calculation is fairly simple. Add the total of their other assets and the total of their non mortgage debt. Deduct the debt from the assets to get their total net worth. Remember, that if they owe more than there home is worth the amount above the fair market value must be added to the debt column.

If you are relying on investors to fill out their own net worth documents include a question asking about their home’s value and mortgage. For example, you could ask “Do you owe more on your home than the current market value?” and “Have you increased your mortgage liability in the past 60 days”. If the answer is yes, direct them to speak with you so you can assist in the final net worth calculations.